Economic indicators are sending mixed signals about the health of today’s economy. Inflation is on the rise and whether we’re in (or will be in) a recession is up for debate. Through it all, B2B sales don’t have to slow down if you understand how an uncertain economy influences buyer behavior.

Predictable Buyer Responses

Selling to another business is harder, but not impossible, in an unpredictable economy. Buyers are understandably more cautious about new purchases and will engage in these behaviors to protect the financial integrity of the organization.

- Cut Costs | Looking for areas to cut costs is one of the first actions companies can be expected to take. This can be a good thing, as inefficiency and overspending tend to grow during times of growth.

- Manage Cash | Cash becomes king when the future is questionable. CFOs will take their companies into what is sometimes referred to as “cash preservation” mode. They will avoid spending cash unless they are confident of a quick payback on that cash.

- Reduce Risk | It’s always wise to look for ways to reduce financial risk, especially in anticipation of economic influences outside your control.

- Grow Sales | Shrinking sales revenue is of great concern. However, downturns can present opportunities to increase sales by focusing on different offerings, different segments of customers, or even different business models. Buyers are likely to look for growth in areas that are counter cyclical.

Sales Strategies for Uncertain Times

The best way to maintain and increase sales is to focus on things that leverage the typical behaviors described earlier. Here are several things you can do, depending on your offering, to continue selling successfully.

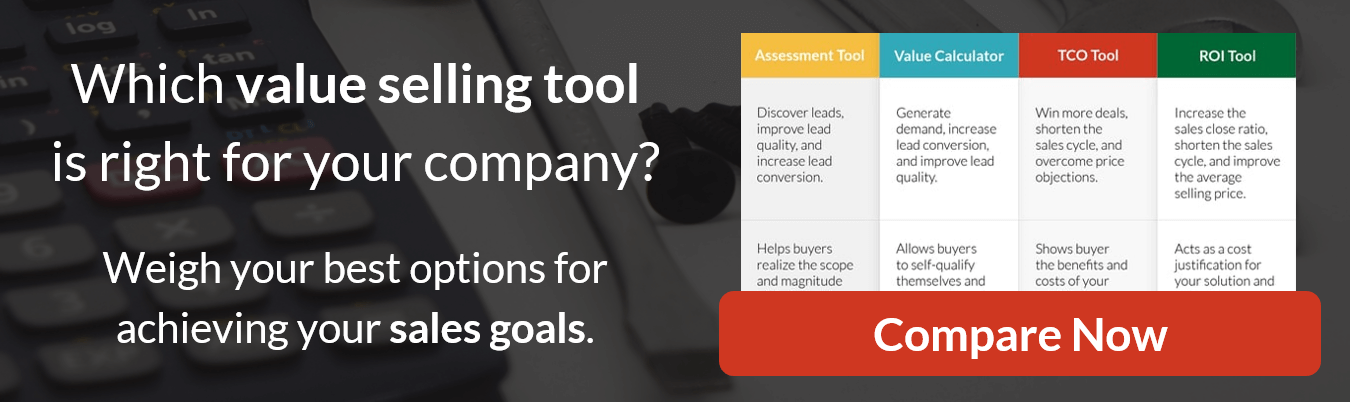

- Show Cost Savings | If your offering can help companies reduce costs in any area, focus on that. Help buyers estimate how much they are overspending and show how your offering can reduce that overspend. Use value calculators to demonstrate that investing in your offering will actually help them to reduce overall costs.

- Focus on Payback | When companies go into cash preservation mode, the CFO may use different metrics to evaluate projects. While they will not ignore traditional metrics like ROI and NPV, they will likely care more about payback period, which will show them when the initial cash outlay will be back in the bank. They are also likely to shorten payback expectations: what could have been 2-3 years before might now be 12-18 months. Bottom line, be sure to help CFOs estimate the payback on their investment and measure that payback in months and not years, which could require changing your pricing model.

- Change Pricing | Look for pricing opportunities that will lower your customer’s initial investment, and thus cash outlay. This doesn’t necessarily mean lowering prices. It could be the perfect opportunity to shift from a large up-front investment to a longer-term subscription. Consider rolling initial investment costs into a longer-term contract or offer financing for the solution.

- Show Labor Savings | The current economy is unique in that we are challenged by both inflation and an anticipated recession… a situation that hasn’t been seen for decades. This is exacerbated by a labor shortage as evidenced by the “help wanted” signs everywhere we go. In the past, vendors were leery about focusing on labor reductions as part of their value proposition because it could seem cold or crass. But now the opposite is true.

Companies are having a hard time finding new workers and when they are able to hire, the cost of labor has grown much more expensive. Instead of focusing your sales message on reducing headcount, focus it on reducing the cost of labor, either by needing fewer people to do the same job or by reducing the cost of that labor with less-skilled workers. - Show Ranges of Outcomes | Because companies are seeking the least risky investment options, your business case should show ranges of possible outcomes. It is not enough to show point estimates. You need to show that even the worst-case scenario still delivers a positive outcome for your customer.

- Show Growth | If your offering can help your customer grow revenue, then help them to estimate the impact of that growth. Does your offering enable them to raise (or maintain) prices or increase volume? If so, help them to estimate the financial impact of the additional margin they will receive from their investment.

Conclusion

Although many of these strategies are good for selling any time, they are especially important to consider during times of economic uncertainty. An economic downturn doesn’t have to spell doom and gloom, but it will require more diligence in your selling efforts.

Focus on what’s important to your customers and show them how you can help them achieve their financial objectives. It may require providing your customers and sales team with new tools to estimate value and deliver a business case in terms that address their current situation and the potential economic influences that lie ahead.

How Can ROI Selling Help?

Here’s how ROI Selling can help you to thrive in tough times.

- Consulting to help refine your value proposition

- Value calculators that demonstrate value relevant to the customers situation

- ROI tools that provide a business case that a CFO will approve

Resources

Connect with Darrin Fleming on LinkedIn.

Join the Value Selling for B2B Marketing and Sales Leaders LinkedIn Group.

Visit the ROI Selling Resource Center.