What are two words that get every salesperson’s pulse racing? Budget approval. Want to know the secret to securing budget approval? Simple. Create the right kind of business case to include with your proposal.

The right kind of business case will win the respect and approval of the CFO (or whomever your stakeholder/prospect will request budget approval from). However, not every selling situation requires the same kind of business case. In general, there are three levels of selling situations, and each requires a different kind of business case: simple, standard, or in-depth. Here’s a breakdown of each one.

Level One | The Simple Business Case

If your offering does not cause much change or disruption to the customer’s business, and is also not a high-ticket item, you do not need an in-depth business case to win the deal. Case studies, industry benchmark data, and white papers would all be helpful. But you probably will not need to build much of a business case, other than possibly a quick calculation showing how much they can save.

Level Two | The Standard Business Case

A standard business case works extremely well for deals that require you to clearly show the customer the benefits they can expect to see, plus the value of those benefits.

In other words, if your offering causes at least a moderate level of change or disruption and is also a substantial investment (say, over $10,000), the prospect will want to see the numbers behind your promised benefits. For example, your offering could be a sales-productivity tool that would enable the customer to reduce labor costs and also achieve higher close ratios. The projected value of those benefits is what your business case should show.

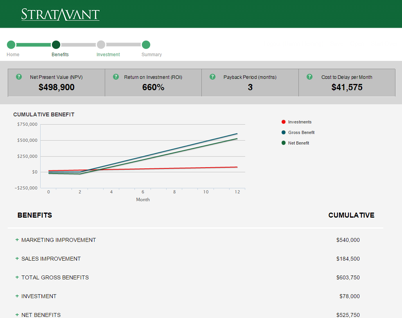

An ROI tool is a particularly easy and helpful way to generate a standard business case. For example, below is a screen capture for an ROI tool that we use with our prospects. This tool helps our prospects create a business case that they can show to their CFO (or other decision maker) to secure approval to invest in our offering. These ROI tools are easy to use and generate a PDF report (i.e., the business case) at the click of a button. The business case then becomes the cost justification needed by your buyer to obtain budget approval.

Level Three | The In-depth Business Case

For high-priced offerings that cause significant change or disruption to the customer’s business, an in-depth business case is absolutely necessary. At this level, you’ll be collaborating with your internal solution experts or an outside consultant hired by your prospect to evaluate current operations and to see exactly what impact your offering would have. For offerings like these (which could cost six figures and up), the financial analysis is so complex that it becomes well worth everyone’s time to invest in a consulting study, and possibly pair it with an intensive ROI tool to help with that analysis.

Resources

Connect with Darrin Fleming on LinkedIn.

Join the Value Selling for B2B Marketing and Sales Leaders LinkedIn Group.

Visit the ROI Selling Resource Center.