I recently reflected on what might cause sellers to reassess their value pricing and value selling strategies in a changing economy. While both are rooted in value, value pricing and value selling use different tools with different purposes and reference sets. Let’s take a moment to review the basics.

Value PRICING Fundamentals

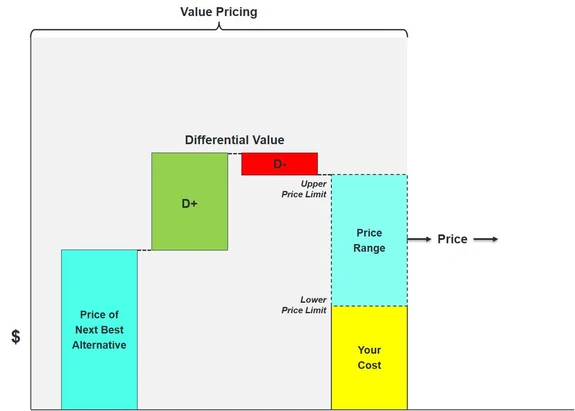

Value pricing considers all relevant factors and is the best way to optimize your business performance through price. You begin by understanding the value your offering creates for a customer.

Keep in mind though that value must be considered relative to the customer’s next best alternative (think competitor) when evaluating your price. Since you can’t charge a premium for something your competitor can do just as well, you must understand the incremental value your offering creates for the customer. This competitor or market price is the starting point for your value pricing equation.

Your maximum price is the price of the customer’s next best alternative (again, think competitor) plus the incremental value your offering delivers relative to that alternative. This then sets the upper limit to your price.

Your cost sets the lower limit—not to calculate your price, but to ensure that your price is greater than your cost. You now have the upper and lower limits of your pricing.

Here is where the nuance comes in. The key to value pricing is choosing the earnings optimizing price within those limits. You need to share at least some of that value with the customer, but obviously you want to keep as much as possible for your business. You can read more about this value pricing dynamic here.

The key thing to note is that the price of the next best alternative is a significant reference point when setting your value price.

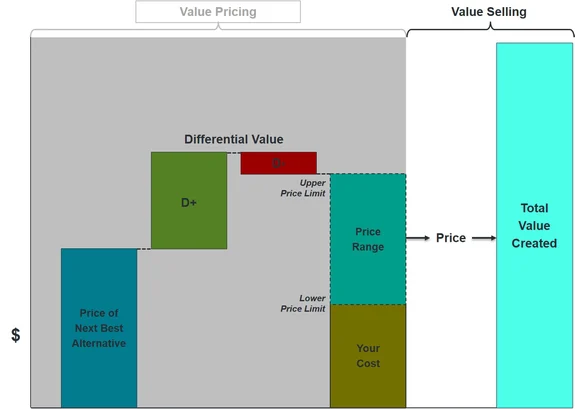

Value SELLING Fundamentals

Value selling focuses on justifying your price, not setting your price. Justifying your price uses metrics such as Return on Investment (ROI) and Net Present Value (NPV). These metrics estimate whether the customer’s business is better or worse off by investing in your offering, relative to what they are doing today, NOT relative to the competitor.

There may be the rare occasion where the customer wants to get into a Total Cost of Ownership (TCO) analysis to compare your offering against a competitor. That doesn’t justify the investment, it only analyzes the total lifecycle cost between the two alternatives. The good news is that if you have done Value Pricing properly, you will win on a TCO analysis as well.

Implications

Although value pricing and value selling both rely on the value you create, their primary difference is their respective reference points.

- Value pricing uses your competitor’s price as a reference point.

- Value selling uses your customer’s current state as the reference point.

If both your and your competitor’s offering create a significant amount of value and your competitor is priced significantly lower than the value created, you could end up with ROI and NPV financial metrics that seem inordinately high. You, and unfortunately your customer, may look at the business case and say, “There’s no way this produces a 150,000% ROI,” when in fact it might. Even though the investment delivers very large returns, your ability to price to capture that value is limited by the competitive price.

The flipside of this is when you look at the investment metrics and think, “We are way underpriced, and we are giving away too much of the value.” Although that may be the case, it might also be true that you aren’t delivering enough incremental value relative to the competitor to sustain a higher price. If you try to set your price based on the total value delivered, and not the relative value delivered, you could end up overpriced.

Value pricing compares against the customer’s next best alternative, whereas value selling usually compares against the current state, or status quo. This can lead to very high ROI, which can be misleading.

Conclusion

It is easy to confuse value pricing and value selling because they both say and rely on customer value. In the end, although related, they are significantly different. Use value pricing to set your price relative to the competition. Use value selling to justify the investment in your offering based on the price that has been set.

How Can ROI Selling Help?

Here’s how ROI Selling can help you thrive in tough times.

- Provide consulting services to help you develop or refine your value-based pricing

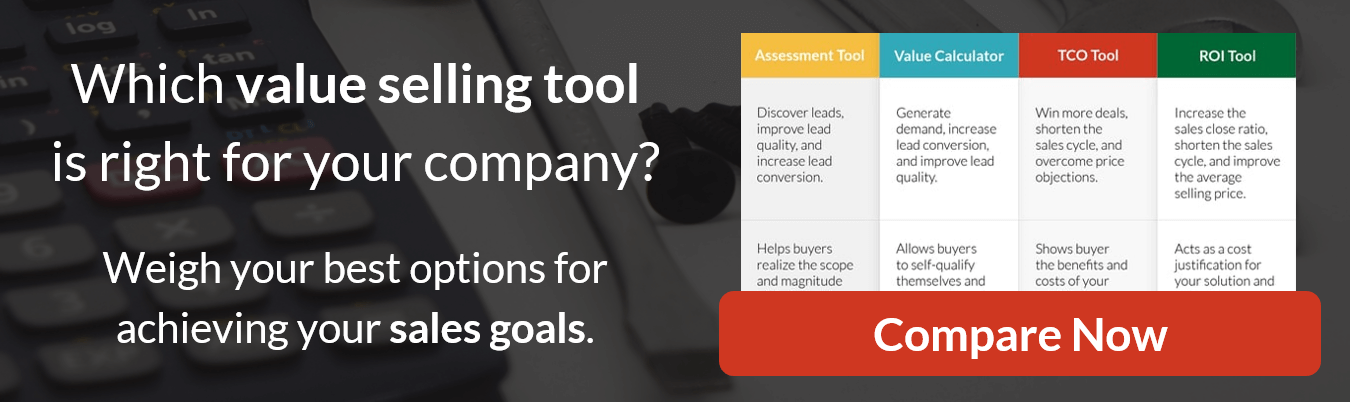

- Build ROI tools to justify your pricing and close more deals

- Deliver value-based sales training and program roll-out support

Resources

Connect with Darrin Fleming on LinkedIn.

Join the Value Selling for B2B Marketing and Sales Leaders LinkedIn Group.

Visit the ROI Selling Resource Center.