If you aren’t selling on value, you are leaving money on the table. The question is, how much?

Let’s go through the three problems with not selling based on value. Each of these events result in lost revenue and profits. Altogether, it can add up to a significant amount of profit lost.

1) A Longer Sales Cycle

The longer it takes to close a sale, the more resources you spend on that lead trying to drive the deal to completion.

A longer sales cycle leads to:

- More dropped leads

- Fewer opportunities

- Missed sales quotas

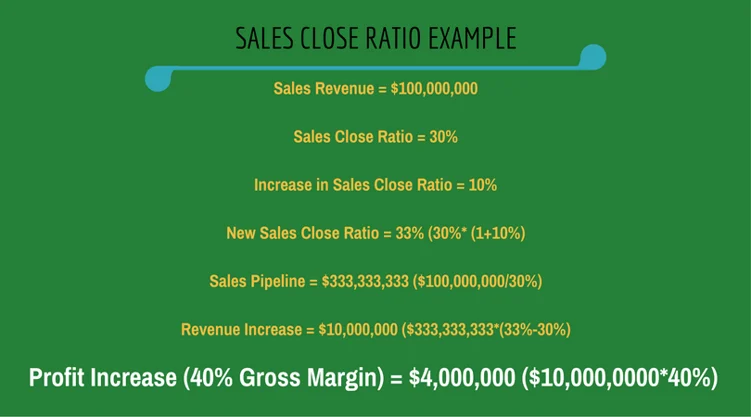

If the sales cycle is shorter, you are closing deals faster and saving resources; in other words, your cost to serve is lower per customer. You are also closing more deals per time period and generating more revenue.

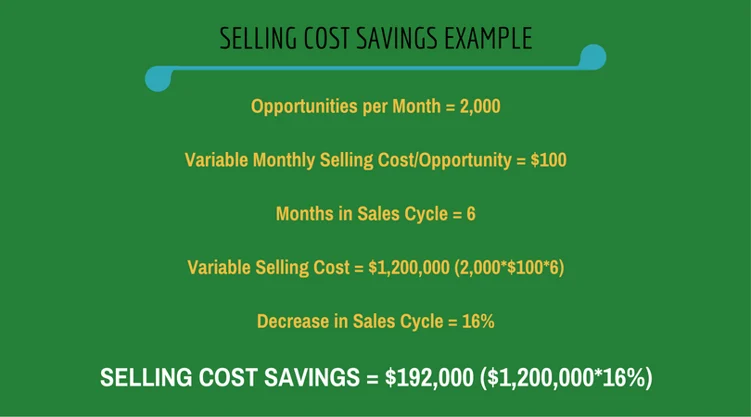

The Aberdeen Group, a data science services company, looked into the length of the sales cycles at different organizations and found that the ones defined as best-in-class had a sales cycle that was 16% shorter than average, and 72% of their sales reps achieved quota (in comparison to the industry average of 48% reaching quota and so-called “laggards” only reaching 37%).

Here’s an example of how much you can save if the length of your sales cycle can be reduced by 16%.

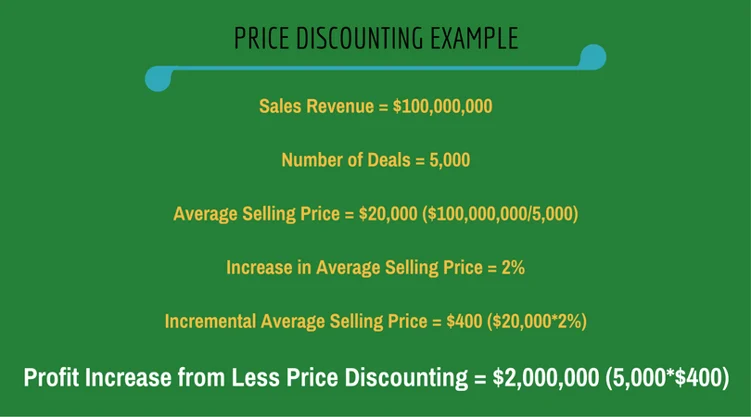

2) Discounting Price

Discounting your price may seem to be the easiest way to close a deal, but it will cost you more than you think. A discounted price not only sends signals that hurt future business, but every dollar of discounted price is a dollar of profit that your company won’t earn.

First of all, discounting sends a subtle message that you lack confidence in your product or service. Your customer will be glad for the discount, but in the back of his or her mind will be the feeling that you don’t think your offering is actually worth the asking price.

Discounting lowers the perceived value of the product or service. This, in turn, eliminates your chance to sell on value because the value has already been reduced (at least from the customer’s point of view).

Furthermore, discounting sets a bad precedent. After all, if you sold it at the discounted price now, why shouldn’t your customer expect an even lower price next time? If you don’t continue to provide the offering at a continually lower price, the customer may well wait until you discount it again or will go somewhere else.

Discounting creates other problems:

- You appear less trustworthy. If the discount is given in the middle of negotiations when the customer has already taken your word that you are already giving the best price you can, you will look like you are going back on that word.

- Discounting focuses the conversation on price, which you want to stay away from when you are selling on value.

- Discounting cuts your profits; you will have to sell more to make the same profit, taking up more resources to do it. You may also lose more sales because you act desperate, a red flag to many prospects.

3) Losing Out to Competitors

Most sellers don’t realize how easy it is for an offering to become a commodity. Let’s face it; there are continually fewer and fewer unique products or services. There is likely another company that offers the same thing as you do and possibly at a lower price.

To combat this, you need to differentiate your company from the others. What are you uniquely qualified to offer that will distinguish you from the rest of the market? Find out by being curious about what your customers need and find a way to answer that need using your product.

Next, show the customer how much doing business as usual is costing and how much will be saved using your solution. Using an ROI tool demonstrates the value created by your solution, justifying your price.

Did you know you have an invisible competitor? Sometimes it goes by the name “No Decision,” and it comes from within your client’s company: The other investment choices available to the finance team. You need to convince this team that investing in your solution is a better choice than allocating the funds elsewhere. The ROI tool provides convincing evidence that your offering is a good investment to your customer’s financial decision makers.

Conclusion

ROI highlights benefits that may otherwise have gone unnoticed. It provides the champion with a compelling argument for the finance team to allocate funds for your solution. It gives your sales person a tactical advantage during price negotiations.

Looking back over the past year, have you noticed your company experiencing these events? Have you lost sales to “No Decision,” or to competitors? Do you find yourself discounting price to win deals?